The current tech disruption positively impacts the market

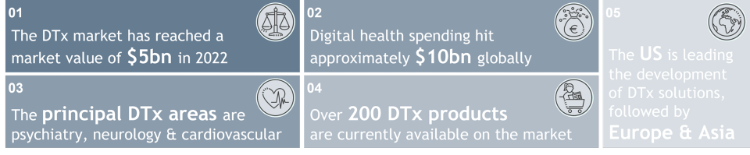

In recent years, digital therapeutics (DTx) solutions have begun to substantially disrupt the current healthcare and pharmaceutical markets. Even though DTx is a rather new concept, the DTx market is predicted to globally reach a value of over $5 billion in 2022. Since digital health spending has recently hit around $10 billion globally, the market is expected to grow exponentially in the next years. The US is leading the development of DTx products, followed by Europe and Asia. DTx products represent clinically tested tools that deliver medical interventions through software and online platforms. The programs are generally based on artificial intelligence, which ensures the analysis of large data sets and provides predictive insights. To further improve real-time healthcare, the solutions are often combined with additional medical devices.

The US Food and Drug Administration (FDA) approved the first prescription digital therapy solution that manages diabetes by WellDoc a little over ten years ago. Not surprisingly, the outbreak of the pandemic further increased the popularity of DTx and led to the approval of numerous new products addressing health issues. As of 2022, more than 200 such evidence-based therapies exist on the market (BDO Market Insights). The figure below displays best practice examples of successful DTx organizations. Generally, DTx products support the diagnosis and/or treatment of various diseases in numerous therapeutical areas, such as mental health, cardiovascular, neurology or pulmonary. However, one might wonder: how can technology- and especially AI-driven products improve patients' health and why do they seem to be a safer, simpler and cheaper alternative compared to regular medication?

Digital treatments offer personalised solutions that not only cost less but also may result in fewer side effects than traditional drug use. Besides treatments, the DTx market also offers an increasing number of monitoring devices. Currently, over 80% of patients use such digital tools, like blood pressure, blood glucose or heart rate monitors as well as other health trackers. In the coming years, more healthcare practitioners and physicians are expected to utilise remote and digital tools, such as remote patient monitoring, telemedicine and AI diagnostics.

DTx products might pose some challenges though

However, there are always two sides to every coin and digital products are thus not without challenges and potential drawbacks. Currently, even though an entry procedure is required, medical devices and DTx products are not entirely regulated. Therefore, since digital programs are generally based on real evidence and real patient data, every second consumer is still concerned about data privacy, confidentiality and security issues. Following the path of traditional pharmaceutical manufacturing, producing and marketing digital software as well as developing the required skills can be time-consuming. Furthermore, the costs of experimentation might even lead to exceeded budgets. Also, explaining the use of digital healthcare products to patients, especially those of older generations, might pose a challenge.

Big pharma companies should watch out for future med-tech trends

Industry changes are constantly linked to major trends market players should address. Generally, pharmaceutical experts expect the rising use of medical robots, virtual-reality healthcare apps and additional wearable products. Nevertheless, firms need to promptly consider the current tendency toward the issues of the ageing population and the P4 medicine approach which is predictive, preventive, personalised and participatory.

Summary

- The traditional pharmaceutical industry has been shaken by new digital and technological innovations

- The emerging Digital Therapeutics (DTx) products offer solutions for many diseases, especially in the areas of mental health and behavioural diseases

- Despite the benefits MedTech solutions offer, marketing and regulating DTx products as well as learning and teaching how to use them is a major challenge

Outlook

Keeping in mind the dominant emergence of DTx products, investigating how MedTech solutions cope with the current issues of the ageing population and P4 medicine is of high relevance. Moreover, one should examine the startup – big pharma collaborations and further future aspects of the MedTech market. Therefore, our question is the following: How are new trends changing the pharmaceutical and healthcare sectors and how should organisations address these challenges?

Author:

Gabriella Panka Hevesi

gabriella.hevesi@bdo.at

+43 5 70 375 - 1250

Abonnieren Sie die neuesten Nachrichten von BDO!

Please fill out the following form to access the download.